A Simple Tool Has Brought Health Insurance to Thousands

Maryland Form 502 - Resident Income Tax Return. Maryland now puts this check box on its tax returns to initiate a process for enrolling residents in health insurance. Image credit: Maryland Health Benefit Exchange

Soon to be followed by other states, Maryland and Massachusetts now allow taxpayers to begin the sign-up for health care coverage on their tax returns, aiming to draw many residents into low- or no-cost plans they may not know they qualify for.

The effort is intended to gather in many of the last Americans — more than 28 million of them — still without health insurance, despite the gains achieved by the 2010 Affordable Care Act.

A quarter of those people are eligible for Medicaid, the public health plan for low-income Americans, according to an analysis of the uninsured by the Kaiser Family Foundation. And more than a third could get federal tax subsidies to help them pay for at least part of the premiums for private plans.

“As surprising as it may seem, there are many people out there who don’t know there are insurance options for them,” said Michele Eberle, executive director of the Maryland Health Benefit Exchange, a state agency that helps enroll residents. “People are just surviving out there. They don’t know what’s available to them.”

Republican Gov. Larry Hogan signed Maryland’s first-of-its-kind measure into law in 2019. For the past two years, Maryland income tax forms have included a box that taxpayers can check to indicate they do not have health insurance. With the taxpayer’s permission, the state comptroller submits the household’s income and family size data to the state’s health insurance exchange for possible enrollment in Medicaid or subsidized private insurance.

The Massachusetts legislature adopted a similar measure this year, which will be implemented next year.

Other states are following suit.

Colorado and New Jersey have passed legislation, both with strong bipartisan support, to implement their own easy enrollment plans via tax returns. Colorado Democratic Gov. Jared Polis signed the bill into law. In New Jersey, Democratic Gov. Phil Murphy said he strongly supports the measure, but has asked for some small technical changes, which the legislature is likely to adopt next month.

The idea also is gaining steam, either legislatively or administratively, in New Mexico, Pennsylvania, and Virginia.

Meanwhile, U.S. Sen. Chris Van Hollen, a Democrat from Maryland, introduced a bill last fall that would put a similar check-off box on federal tax returns.

Van Hollen cited the success in Maryland, which has enrolled nearly 7,000 residents over the past two years, according to the Maryland Health Benefit Exchange. The state’s uninsured rate was 6% in 2019, the last year for which statistics are available. Nationally, according to last year’s census, the percentage of those without health insurance is 8.6%.

Proponents say a check-off box on federal tax returns would alert many of those taxpayers of their options and usher them into health insurance plans.

In 2020, the first year of Maryland’s Easy Enrollment program, 60,645 Maryland taxpayers checked the box indicating they didn’t have health insurance. The state determined that 53,146 were eligible for either Medicaid or a federal tax credit. Of those, 4,015 people, or 7.6%, ultimately enrolled in a health plan.

This year, 29,020 individuals checked the box, 27,223 were found eligible and 2,962, or 10.8% of those deemed eligible, enrolled.

“We’re pleased with that 10%,” said Eberle. “Although it sounds low, it’s 10% more than we would have gotten otherwise.”

Most of the other taxpayers didn’t respond to the state’s outreach. Nevertheless, Eberle said the information collected from the tax returns could help her office to better target its marketing and education campaigns.

Carmela Peterkin-Wilson, a navigator with the Maryland Health Connection, enrolls a resident in a health insurance plan in 2019. That year, the state enacted a law that authorizes the use of state tax returns to begin enrolling uninsured Marylanders in health plans. Other states are following suit. Photo: Mike Morgan

Of those who enrolled in health care plans through their Maryland tax return, Eberle said nearly a quarter identified as Black and 20% as Latino. More than 40% were ages 18 to 34, a group notorious for low rates of insurance.

Nearly three-quarters of the new enrollees joined Medicaid. The rest enrolled in commercial plans, and about 95% of them qualified for federal tax credits, Eberle said.

The Easy Enrollment concept in Maryland originated in the Maryland Health Insurance Coverage Protection Commission, a panel comprising lawmakers, hospitals, and other providers and consumer advocates that the legislature created to recommend measures to improve access to health care in Maryland.

One of the commission goals, said Vinny DeMarco, a member of the commission and president of the Maryland Citizens’ Health Initiative, was to scoop up the last 6% of Marylanders without health insurance.

And one way to do that, he said, was to leverage residents’ interactions with government bureaucracy, such as tax-collecting agencies.

“The success of the ACA is terrific, but we need to get the rest of the way for health care for all Marylanders and Americans,” he said.

The Pew Charitable Trusts is an independent nonprofit organization dedicated to applying a rigorous, analytical approach to improve public policy, inform the public, and invigorate civic life. It is a global research and public policy change agent that remains nonpartisan and dedicated to serving the public.

Stateline provides daily reporting and analysis on trends in state policy. Founded in 1998, its team of veteran journalists combines original reporting with a roundup of the latest news from sources around the country.

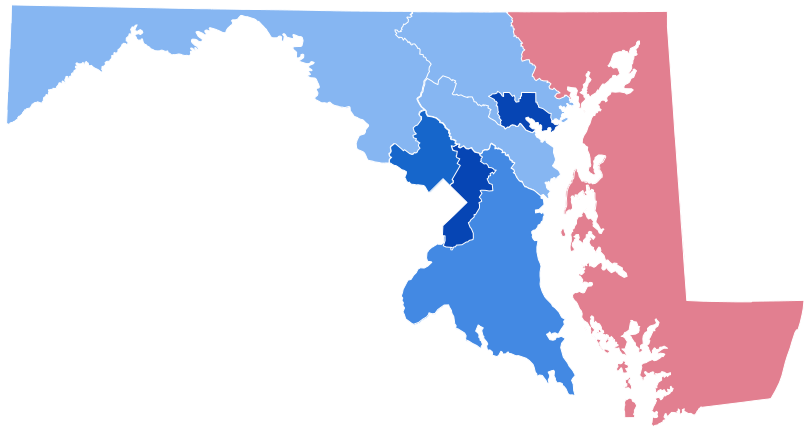

Common Sense for the Eastern Shore