How Much Did the Restaurant Revitalization Fund Help Eastern Shore Businesses?

The U.S. Small Business Administration recently released its database of businesses helped through the Restaurant Revitalization Fund, a $28.6 billion fund created to provide emergency assistance to restaurants hurt by the covid-19 pandemic. The RRF is part of the American Rescue Plan stimulus bill, passed by the House and Senate without a single Republican vote, and signed into law in March 2021.

Restaurants were hit by the pandemic perhaps harder than any other type of business. They were shut down or limited to carryout service, restrictions were placed on indoor dining, patrons were encouraged not to dine out, and many restaurants closed their doors for good.

The RRF, unlike the earlier Paycheck Protection Plan, was designed with the restaurant industry in mind. For example, the PPP required that funds be spent on retaining workers, but restaurant staff were laid off; RRF allowed more flexible use of grant funds. Eligible uses include utilities, mortgage, rent, operational expenses, and some supplier costs, in addition to payroll costs. And big chain stores gobbled up the PPP funds before the small businesses could get a loan. RRF funds are targeted at small businesses.

Grant funding up to $10 million per business (but no more than $5 million per location) was available; grants were to equal the amount of revenue a restaurant lost during the pandemic. Recipients are not required to repay the funding as long as funds are used for eligible uses no later than March 2023. Businesses applied directly through SBA, eliminating the favoritism shown by banks for PPP applications.

By the time applications closed, over 370,000 applications had been submitted, for over $75 billion in funding — two-and-a-half times the total amount in the program. Only about 105,000 restaurants received grants, averaging slightly above $272,000 each.

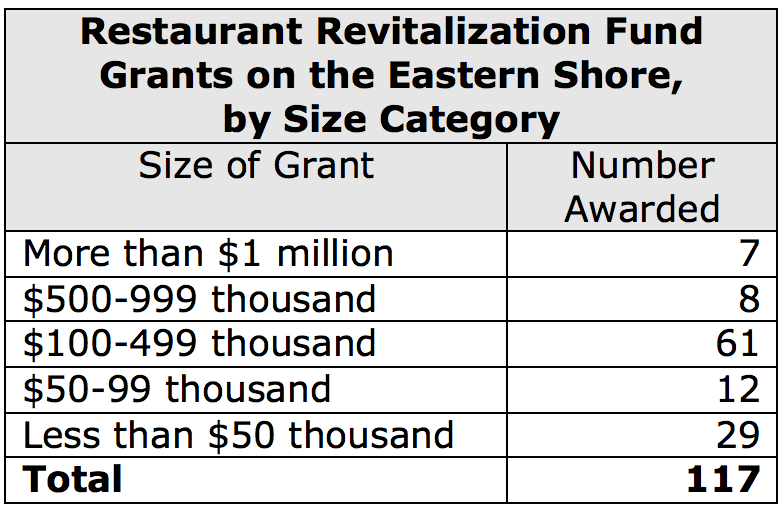

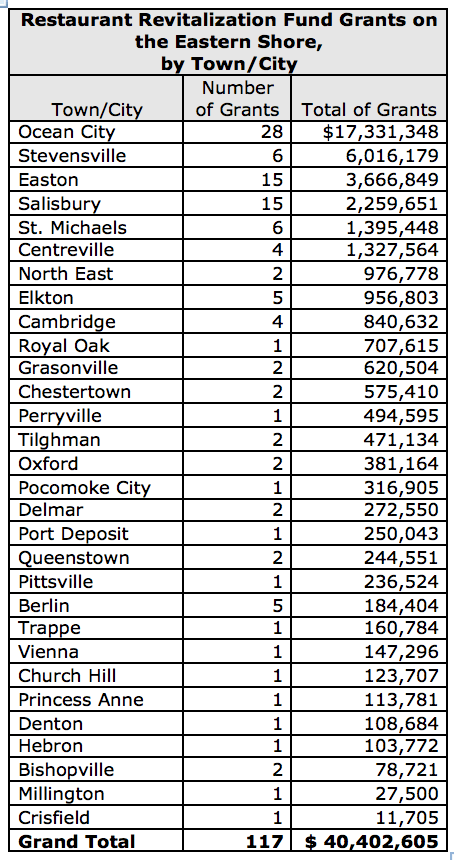

On the Eastern Shore, 117 businesses received grants through RRF. The largest grant was for $5 million to the Chesapeake Bay Beach Club LLC in Stevensville. The smallest was for $9,424 to DeCarla’s Treats Bakery in Salisbury. Most grants were less than $500,000; only 15 grants of over $500,000 were awarded. The average grant was $345,321, but this number is skewed by the larger grant amounts awarded. A better measure — the median grant amount — was about $150,000, meaning half of recipients received more than that, and half received less.

The largest category of grantees was restaurants, at 66. Bars and bar-restaurants was the next largest, at 20. The remaining 31 establishments were split between bakeries, breweries, caterers, food stands, inns, and other.

Worcester County received the largest number of grants, 35, and the largest total grant amount, over $18 million. Twenty-eight of the grants went to businesses in Ocean City. Five Ocean City restaurants received grants over $1 million (Embers Restaurant, Phillips Crab House, Dead Freddie’s Island Grill, Tio Gringos, and De Lazy Lizard).

Queen Anne’s County received the next highest total grants, over $8 million ($5 million of which went to one recipient).

Talbot, Wicomico, and Cecil Counties were awarded total grant amounts of over $2 million. The rest of the Eastern Shore counties received five or fewer grants, totaling less than $1 million. Caroline County received one grant, to Market Street Public House in Denton.

Originally, the SBA identified several priority groups to receive aid during the first three weeks of the program: women, veterans, and socially or economically disadvantaged owners — groups that had missed out on earlier aid. However, three conservative-backed discrimination lawsuits challenged the priority ranking and were successful, redirecting money away from those who needed it most. Businesses that had been informed they would receive funds were then told they would not — often after rehiring and reopening based on the promise. The industry charges that the SBA then made arbitrary decisions in awarding grants, resulting in calls for increased fairness and transparency.

Nevertheless, there were 51 women-owned businesses awarded RRF grants on the Eastern Shore, but only eight veteran-owned businesses, and 25 businesses with socially or economically disadvantaged owners.

Unfortunately, the RRF ran out of money in June. Rep. Earl Blumenauer (D-Ore.), who proposed the original RRF, has introduced legislation to add $60 billion to the fund. Even with more than 175 bipartisan co-sponsors, it is unclear what the future holds. In a recent statement, Rep. Blumenauer said, “Hundreds of thousands of local restaurants still desperately need help to keep their doors open. We need to act now before it’s too late.”

Sources:

U.S. Small Business Fund, Restaurant Revitalization Fund (RRF) FOIA.

https://data.sba.gov/dataset/rrf-foia

Elazar Sontag, “Congress’s Restaurant Revitalization Fund Is Out of Money and Restaurants Are Still in Need,” Eater, 7/2/21.

Christina Tkacik, “Phillips Seafood in Baltimore got $5M in COVID relief. Faidley Seafood got $0. SBA says court cases put halt to priority group payments.” The Baltimore Sun, 7/23/21.

Replenish the Fund.

https://www.replenishthefund.org/

Jan Plotczyk spent 25 years as a survey and education statistician with the federal government, at the Census Bureau and the National Center for Education Statistics. She retired to Rock Hall.

Common Sense for the Eastern Shore