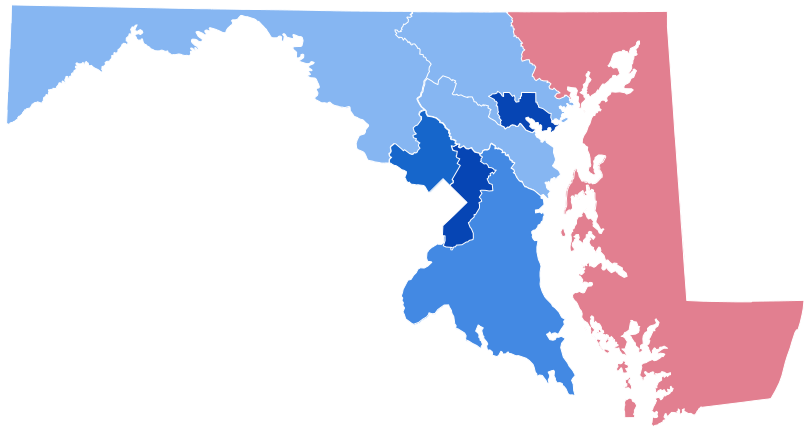

Maryland Senate Primary — Key to Control of U.S. Senate?

The Maryland State Primary Election is set for May 14, and one of its biggest tasks is deciding who will be the Democratic candidate for U.S. Senator from Maryland in the November general election.

The current senator, Ben Cardin (D), is retiring after three terms, following 20 years in the U.S. House of Representatives.

Now Cardin will be replaced, and that new person’s party — Republican or Democratic — will help decide control of the Senate for the next two years.

Maryland has not elected a Republican to the Senate since 1980. However, this year, whoever wins the Democratic primary will probably run in November against Larry Hogan, the former Republican governor from 2015 through 2023. Hogan was popular with a large number of Marylanders from both parties. His unexpected last-minute entry into the senatorial race in February heightened the stakes in the Democratic primary.

The big question for Democrats now appears to be “Who has the best chance to beat Hogan in November?”

Although there will be 10 candidates on the Democratic primary ticket, the two front-runners are Angela Alsobrooks and David Trone. Both are liberal Democrats with similar views, thus making it trickier for voters to choose between them.

Both support environmental issues, reproductive rights, Medicare and Social Security, along with expanded health care and services for various groups.

Their resumes reflect some differences, both working in government but in different areas. Alsobrook’s expertise is in management and administration, while Trone’s government experience is in legislation.

Angela Alsobrooks

Angela Alsobrooks is the chief executive of Prince George's County, the first woman to hold that office and the first Black woman to hold a county executive office in Maryland. Her experience is in implementing and directing policy, figuring out what works and what doesn’t, and finding and managing personnel. She has focused on jobs, education, and expanding health care access, including mental health and addiction treatment.

She is a former state's attorney for Prince George's County, as well as that county's first full-time domestic violence prosecutor.

According to her website, “Angela has been endorsed by Gov. Wes Moore, Sen. Chris Van Hollen and over 150 elected officials, labor unions, and organizations across Maryland.”

Union endorsements include Amalgamated Transit Union (ATU), American Federation of Government Employees (AFGE), International Association of Machinists and Aerospace Workers (IAM), International Brotherhood of Electrical Workers (IBEW) Locals 70 & 1900, and the Teamsters Local 639 and Joint Council 55.

Alsobrooks has stated that on her first day in office, she will co-sponsor the Women's Health Protection Act, legislation that will help establish federal legal protection for the right to provide and access abortion care across all states. Additionally, she will oppose any judicial nominee who does not support abortion rights.

David Trone

David Trone has extensive experience as an entrepreneur and businessman, plus several years of legislative experience in the U.S. Congress. He is a co-founder of Total Wine and More, a highly successful national liquor store chain.

Last year, Trone won re-election to a third term as the representative from Maryland’s 6th Congressional District.

In the U.S. House, Trone worked on multiple issues including medical research, mental health, opioid addiction, and criminal justice reform.

On Trone’s website he proudly states that “he’s never taken a nickel from PACs, lobbyists, or corporations” and thus is not beholden to any special interests.

Trone is an original co-sponsor of the Women’s Health Protection Act, which aims to codify Roe v. Wade’s protections and establish a nationwide right to abortion. He also supports the Equal Access to Abortion Coverage in Health Insurance (EACH) Act.

Trone belongs to the Congressional Pro-Choice Caucus and his voting record in Congress has received a 100% approval rating from both Planned Parenthood and Reproductive Freedom for All. He has also shown his support for reproductive rights by endorsing and speaking at the opening of an abortion clinic that moved to his district to serve Western Maryland and surrounding states.

Trone pulls no punches. Regarding Hogan’s entry into the Senate race, as reported on his website, Trone stated that Hogan’s candidacy is a “desperate attempt to return Mitch McConnell and Donald Trump to power and give them the deciding vote to ban abortion nationwide, suppress votes across the country, and give massive tax cuts to the wealthiest Americans. Marylanders are tired of empty promises from career politicians like Larry Hogan. During his time as governor, Larry Hogan neglected and failed the city of Baltimore, pushed for policies that kicked 200,000 Marylanders off the voter rolls, and cut backroom deals to benefit developers like himself at the expense of Maryland taxpayers….”

See the candidates’ websites for more information on their views on other issues such as education, immigration, environment, and more.

Campaign Finances

Trone has outspent Alsobrooks by roughly ten to one. Trone’s campaign has run television ads across Maryland since last fall and reported spending $23.1 million through the end of 2023. In the same period, Alsobrooks spent about $2.4 million. Trone’s campaign is primarily self-financed from his fortune as a businessman.

Alsobrooks is funded mostly by grassroots campaign donations and a few donations from Political Action Committees. She decided not to run television ads until just a few months before the primary. Her staff and staff payroll are considerably smaller than Trone’s.

How much this financial difference will translate into votes is unclear. While larger war chests and more media buys have been shown to influence potential voters, political experts note that a better-funded campaign does not always guarantee electoral success. History has shown that results vary, although having more financial resources does tend to give a campaign an edge.

Campaign finance data for the first quarter of 2024 was due on April 15.

Polls

According to two polls, Trone has an early advantage for the primary election.

A poll by Goucher College in partnership with the Baltimore Banner was conducted in late March. Of Democrats who are likely to vote in the primary, 42% favored Trone. Alsobrooks was favored by 33%. Nearly a quarter of voters are undecided between the two candidates. The margin of error was 4.9%.

Another poll — this one by the Washington Post and the University of Maryland from early March — showed Trone leading Alsobrooks 34% to 27% among registered Democrats. However, almost four in 10 Democratic voters stated that they were still undecided. The margin of error was 4.5%.

Both polls indicate that neither Democratic candidate has a clear advantage over Hogan in the general election. Both matchups — Trone vs. Hogan and Alsobrooks vs. Hogan — are, at the moment, statistically tied.

The Current U.S. Senate

Every state has two senators who each represent the entire state. Each senator serves for six years, and the terms overlap so that, except under unusual circumstances, there is only one senate election in a state at a time. Maryland’s other senator is Chris Van Hollen (D), whose term ends in January 2029.

The primary results in Maryland as well as in several other states may have a significant impact on which party controls the Senate, which currently has 51 Democrats and 49 Republicans. Those 51 Democrats include three Senators who are Independents but caucus and vote with the Democrats, thus giving the Democratic Party control of the Senate and the right to name the Senate Majority Leader. Any tie votes in the Senate are broken by the vice president of the United States, who, according to the U.S. Constitution, officially holds the office of Senate president, and may only vote when there is a tie.

In the upcoming general election in November, 34 senatorial seats will be up for election. Of those 34 seats, 23 are currently held by Democrats. Many of these Senate seats have incumbents who are running for re-election; in most cases these incumbents are expected to retain their seats. However, nationally there are several open Senate seats due to retirements, deaths, or other reasons. These include Dianne Feinstein’s (D) seat in California, Debbie Stabenow’s (D) in Michigan, and Mike Brown’s (R) in Indiana.

When West Virginia Sen. Joe Manchin (D) announced that he would not run for re-election, most commentators allowed that that decision would almost certainly hand the seat to the Republicans. This would bring the Republican party one seat closer to regaining Senate control unless the Democrats pick up one or more seats in other states to compensate. Most of the Senate seats with no incumbent, including Maryland’s and Michigan’s, are considered tight races, any of which alone or in combination could determine which party ends up in control of the Senate starting in January 2025.

Be sure to vote!

-----

Maryland Primary Election Basic Information

The Maryland Board of Elections has information here along with links to find your polling place, request an absentee/mail-in ballot, track your ballot, and sign up to be an election judge.

Here’s the schedule for the Maryland primary election:

In-person voting:

- April 23 — Last day to register to vote in the primary election

- May 2 — Early voting begins, 7 am-8 pm

- May 9 — Early voting ends, 7 am-8 pm

- May 14 — Primary election day, 7 am-8 pm

Absentee/Mail-in voting:

- Any registered voter may request an absentee/mail-in ballot.

Voter registration deadline — for new voters or to add/change party affiliation:

- In-person: May 14

- By mail: Received by April 23

- Online: April 23

Absentee/mail-in ballot request deadline:

- In-person: May 14

- By mail: Received by May 7

- Online: May 7

Absentee/mail-in ballot return deadline:

- In-person: May 14

- By mail: Received by May 14

More Information:

“United States Senate Election in Maryland, 2024,” Ballotpedia: The Encyclopedia of American Politics

https://ballotpedia.org/United_States_Senate_election_in_Maryland,_2024

Jane Jewell is a writer, editor, photographer, and teacher. She has worked in news, publishing, and as the director of a national writer's group. She lives in Chestertown with her husband Peter Heck, a ginger cat named Riley, and a lot of books.

Common Sense for the Eastern Shore