Remember the Tax Law Change? It’s Coming!

It’s November 2018. Are you ready for the new tax law signed into law in December 2017? Do you think you will understand how this new law will impact your tax situation?

I can tell you this: while the Treasury Department is working on regulations to make the new law understandable, the under-funded Internal Revenue Service (IRS) is preparing the forms to implement and enforce the law. It will be complicated so expect a rough tax season for you and/or your tax preparer.

The new tax law was originally called the “Tax Cuts and Jobs Act.” But the law’s official name was changed to “Act to provide for reconciliation pursuant to titles II and V of the concurrent resolution on the budget for fiscal year 2018.” Perhaps the use of the term “Tax Cuts” gave the impression that the new law was a tax cut for all. Tax professionals and scholars have now had time to dissect the new law and what they have found is increasingly bad news for middle- and low-income taxpayers.

The more you learn about it, the more you realize that the true beneficiaries of the tax law are corporations, pass-through entities, and the wealthy. The corporate tax rate was cut from 35% to 21%. Corporations are making more money than ever, which explains the rise in stock prices that benefit shareholders. Pass-through entities, like sole proprietors, partnerships, and LLCs, get a 20% deduction. These two changes alone are contributing to the three major problems: 1) worsening inequality by benefiting the wealthy; 2) reducing revenue significantly when the federal government needs funds desperately, especially for Social Security and Medicaid, whose funds the federal government has consistently raided over the years; and 3) creating incentives for the wealthy to seek aggressive tax avoidance schemes to lower their taxes even further. Unfortunately, technical corrections will not be able to fix the problems. We should have had a better tax law to protect the low- and middle-income taxpayers.

For decades, income has shifted from the bottom and middle-income distribution to the top. Wages for working families have been stagnant as the top earners keep earning more. Income going to the bottom 60% fell by 4.4% between 1979 and 2014, while the flow to the top 1% rose by 5.7% according to the Congressional Budget Office. Unfortunately, the new tax law does very little to stop this trend. By 2025, the after-tax incomes for the top 1% will increase almost 3 times the meager 1% gain for those in the bottom 60%. Tax cuts in 2025 will average $61,100 for the top 1% and $252,300 for the top 1/10th of 1%.

The economic condition of the middle- and low-income working families had a low priority in the new law regardless of what the Trump Administration has stated. Keep learning and keep reading about this new tax law. We are all in for an interesting tax season.

(reference: https://www.cbpp.org/research/federal-tax/new-tax-law-is-fundamentally-flawed-and-will-require-basic-restructuring#_ftn1)

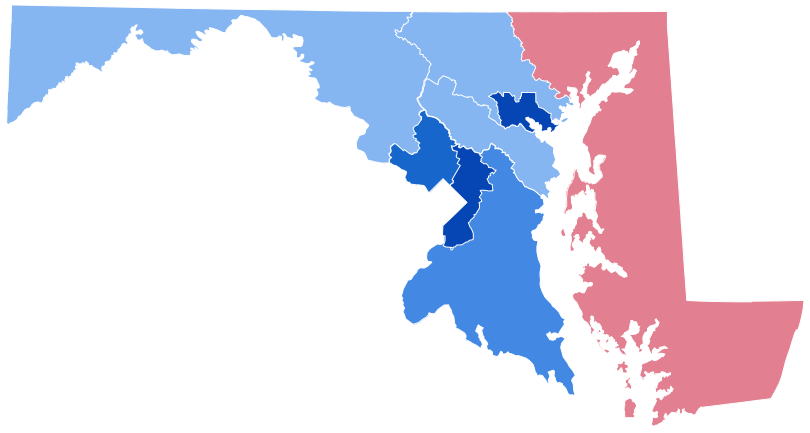

Common Sense for the Eastern Shore