Trade Wars – China & Chicken

The Situation:

One of the joys of living in the rural counties of the Eastern Shore is we can often ignore media hype about the importance of the global economy. However, the ongoing US effort to force other countries to buy more from the US than we sell to them, by threatening to impose tariffs (import taxes) on their exports, could affect our agriculture-based economy here on the Eastern Shore of Maryland. Here’s why.

The Trump Administration decided early on to strike back at what they consider to be other countries’ unfair trade practices as measured by our large trade imbalances with them, i.e., we sell them fewer products and services than we buy from them. The US Government believes these trade deficits cause fewer jobs to be created for American workers.

China’s practices are considered particularly bad. They include: subsidizing exports to lower sales prices, requiring US firms to transfer/share technology to gain access to its huge market (1.4 billion people), and manipulating the value of its currency (Yuan) to increase dollar denominated import prices. The 2017 US trade deficit with China was $376 billion; that is, we exported $130 billion to China while we imported $506 billion from China.

The Eastern Shore Connection:

Maryland is a small state that exported $9.2 billion of goods and services in 2017 (US total was $2.3 trillion). The state’s biggest export markets are Canada, UK, and Belgium accounting for approximately $2.5 billion, but the third largest individual market is China at $600 million. Agriculture is not only Maryland’s largest industry ($2.2 billion), to which the Eastern shore contributes 59%, but also a major export component. The three biggest shares are: poultry 33.5%, soybeans 19.5%, and feed grains 12%.

The Challenge:

Much of the national and international news addressing America’s more proactive trade policy has been directed at other countries’ reactions to our tariff impositions. The Federal Government slapped 25% and 10% tariffs on steel and aluminum imports respectively and lower rates on washing machines and solar panels (major Chinese exports to US).

An immediate problem arose. Close American allies, e.g. Canada, South Korea, and the European Union accounted for most of the steel and aluminum imports. They were given a temporary exemption.

The China Challenge:

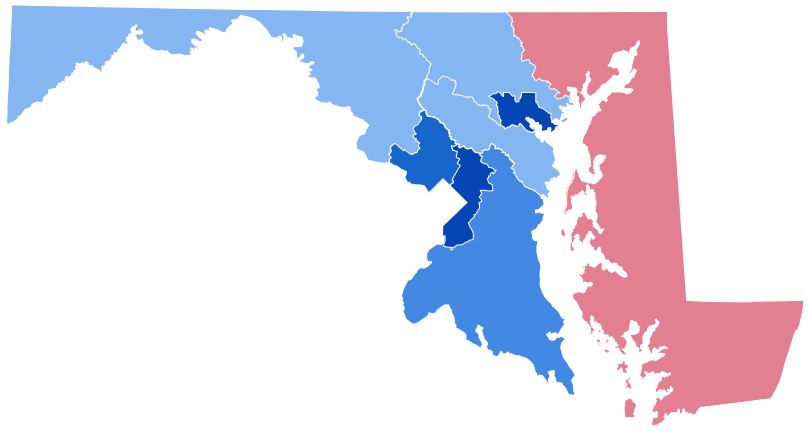

In early 2018, Trump identified three clusters of products on which he imposed or threatened to impose tariffs. The first was a global tariff on steel and aluminum imports into the US, which impacted our close allies. He quickly gave them a short exemption, but maintained it on everyone else. The second two were tailored to China. Each cluster is worth about $50 billion, for a total of some $150 billion. The Chinese countered with their own tariffs on bourbon and cars and later possible tariffs on an additional 100 US products including pork, fruit, and recycled aluminum and steel pipes. Most recently, the Chinese have targeted tariffs on soybeans, grains, and sorghum for a total of approximately $150 billion. This could seriously impact markets and prices for the shore’s soybeans and grain. Ironically, the states hardest hit by these tariffs--many mid-western states--are among those who voted for President Trump in 2016.

Latest Development:

In a May 15 Tweet, President Trump announced he and President Xi have reached a tentative deal: the US will reverse its tariff on a Chinese state-owned telecom giant with 75,000 employees to prevent it from closing. In return, China will remove its tariffs on some agricultural products, among them wine and sorghum.

Is this a hint that a trade war between the US and China won’t take place? Perhaps, but it does add more uncertainty for Eastern Shore farmers concerning markets and prices for this year’s crops.

Common Sense for the Eastern Shore