We Can’t and Shouldn’t Turn the Clock Back, But…

Believe it or not, those who idealize the 1950s may be right on target, at least in some areas:

- By the mid-50’s the U.S. was at peace for the first time in almost a decade.

- The Supreme Court’s decision in the Brown vs. Board of Education case outlawing school segregation opened the way for the civil rights movement, leading eventually to much greater racial equality.

- During the administration of President Dwight D. Eisenhower from 1953 to 1961, the top income tax bracket in the U.S. was 91% and taxes on corporate profits were two times greater than they were in 2017. The tax on large estates went up to more than 70%. And keep in mind that Eisenhower was a Republican, albeit of the old school.

- One third of workers were unionized and on an equal footing for negotiation with management.

- In 1955 Fortune magazine reported that the incomes of the top 0.01% of Americans had dropped by more than half of what they had been in the 1920s and their share of total income had dropped by 75%.

- The average corporate CEO received a salary 20 times greater than his company’s typical employees, while by 2016 the salaries of CEOs were more than 200 times more than that of the average worker.

- Well-paid workers were able to consume more, thereby leading to business expansion and hiring, and thus raising corporate profits and producing higher wages and more hiring.

Since the passing of that halcyon period of economic growth and greater income equality, this country has basically jumped back to the period of the “Robber Barons” of the late 19th and early 20th centuries. That transformation began during the administration of President Ronald Reagan and has continued when Congress has had Republican majorities and under other Republican presidents, culminating in Donald Trump’s major tax cuts for the wealthy in 2017 with the Tax Cuts and Jobs Act of that year.

In a written statement presented to a Senate Budget Committee hearing on “The Income and Wealth Inequality Crisis in America,” Sarah Anderson, director of the Global Economy Project at the Institute for Policy Studies, made the following points:

- In 1980 the CEOs of big companies average 42 times more compensation than their typical workers. During the present century, the annual gap has averaged 350 to 1.

- Women and workers of color make up a disproportionate share of low-wage workers and a tiny share of corporate leadership: only 1% of CEOs in the 500 largest corporations are Black, 2.4% are Asian, 3.4% Latino, and 6% women.

- The financial crisis of 2008-09 is “a dramatic example of how corporate pay practices that incentivize reckless behavior put us all at risk.”

- Contributing to the crisis, according to a Harvard study, publicly held corporations, especially the largest ones, extended huge executive stock grants when the market was at its lowest. These grants drove up executive compensation at Russell 3000 firms by 37% between 2008 and 2010.

- Corporate CEOs have taken advantage of the covid crisis by outsourcing jobs and turning many others into low-wage, part-time work without benefits. Examples given by Anderson include Coca Cola, Tyson Foods, and Carnival Cruise Lines.

- A Harvard study on the negative impact of large pay gaps on company performance reinforce the theory proposed by Treasury Secretary Janet Yellen in 1990 that pay disparity causes resentment among lower-level employees resulting in their taking actions, such as shirking or quitting, thereby undermining the company’s effectiveness.

- In 2016 a Stanford survey showed that 52% of Republicans want to cap CEO pay relative to worker pay.

In her testimony Anderson made the following recommendations for reducing income inequality:

Tax Excessive CEO Pay Act. This legislation would apply a graduated tax rate increase on large corporations based on the size of the pay gap between their CEO and the median worker.

Financial Transaction Tax. Placing a financial transaction tax on Wall Street trades would generate much needed revenue and curb executive excess.

CEO pay ratio incentive in federal procurement. Giving corporations with narrow pay ratios preferential treatment in granting government contracts.

Close the “carried interest” loophole. “Carried interest” refers to earnings that are tied to a percentage of the company’s profits. It is actually compensation for managing other people’s investments and should be taxed as regular income.

Fully close a loophole that allows unlimited tax deductions for excessive pay.

Restrict stock buybacks.

Require top financial executives to contribute compensation into a fund to pay for penalties.

Finalize and firmly enforce the remaining Dodd-Frank executive compensation reforms.

Additional recommendations made by Anderson include making it easier to organize and form labor unions, taxing the accumulated wealth of the ultra-rich, taxing investment income at the same rate as income from work, raising corporate income tax rates on offshore profits to make them equal to domestic rates, and shutting down the means used by the wealthy to hide money and avoid taxes. Further, she suggests broadly canceling federal student debt and establishing a “baby bonds” program to help narrow the racial wealth divide. “Baby bonds” refers to a government policy in which every child at birth would receive a publicly funded trust account, potentially with more funding for lower income families.

Democrats in Congress are working to remedy tax inequities and salary inequities. President Biden also made his intentions clear for 2025 before he dropped out of the electoral race. There is no doubt that Vice president Harris agrees.

The Democrats’ plan is to increase the tax rate of the wealthy and of corporations. The increased revenue would be invested in childcare programs, internet access, and housing.

A proposal introduced by progressive legislators, including Sen. Elizabeth Warren (D-MA), this year would put into effect a 2% tax on households worth $50 million to $1 billion and a 3% tax on those worth more than a billion. According to an article in USA Today by Riley Beggin, it would affect the wealthiest 100,000 households in the country, which amounts to about 0.05% of the population. It includes provisions to prevent people from dodging the tax. The proposal also includes a 40% exit tax on those worth more than $50 million who dump their citizenship to avoid paying. According to the Wharton Budget Model at the University of Pennsylvania the proposal would produce an estimated $2.7 trillion over the next decade.

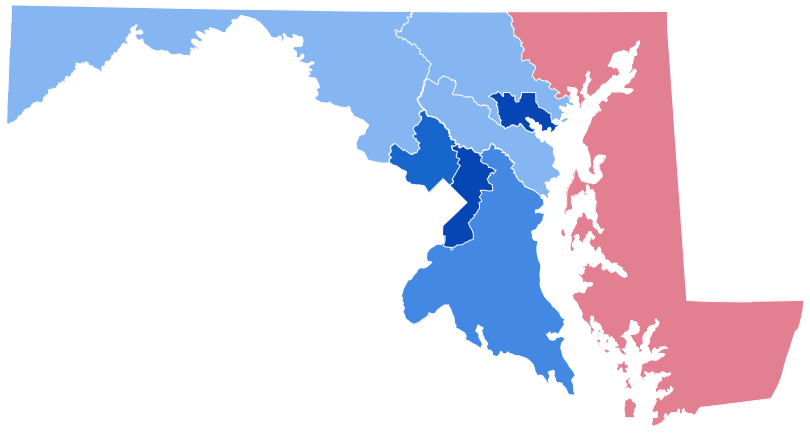

Much hangs on the election in November. We cannot expect any major changes in tax policy or in income inequities without a substantial victory by the Democrats. They must take not only the presidency, but also win majorities in the House and Senate. That can only happen if the Party wins over Independents and moderate Republicans.

A native of Wicomico County, George Shivers holds a doctorate from the University of Maryland and taught in the Foreign Language Dept. of Washington College for 38 years before retiring in 2007. He is also very interested in the history and culture of the Eastern Shore, African American history in particular.

Common Sense for the Eastern Shore